Understanding Dow Theory: When any trader analyzes the stock market there are a lot of ways, a variety of tools, and different kinds of theories to make an informed decision. Dow theory is the oldest and most respected theory in technical analysis that was developed by Charles H. Dow. Dow theory provides a framework for analyzing market how the market behaves and how a financial instrument price moves to predict trends. In this blog, we will understand the key principles of Dow theory.

Six Core Principles of Dow Theory:

There are Six fundamental principles of Dow Theory that guide you about market analysis:

The Market Discounts Everything: Dow Theory assumes that all available information which may be economic, political, and social is already reflected in the price of stocks. Price movements you are watching in the present are the result of all this collective information.

The Market has Three Trends: According to this theory the market moves in these three trends:

- Primary Trend: The overarching direction of the market, lasting months to years. It represents a bull market if prices goes higher or bear market if prices goes downward.

- Secondary Trend: A correction within the primary trend, lasting from weeks to months.

- Minor Trends: Short-term fluctuations lasting days to weeks, often noise in the market.

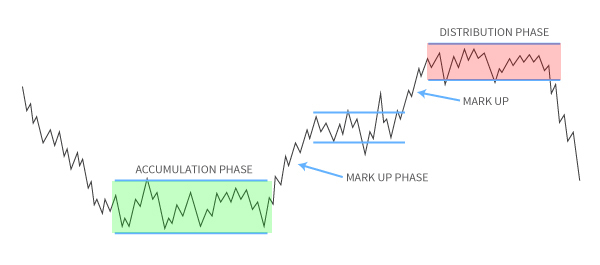

Primary Trend have three Phases: These are the three phases of the primary trend:

- Accumulation Phase: Smart Money (Informed or institutional investors) start buying or selling, anticipating a change in trend. Public sentiment is largely neutral or pessimistic.

- Public Participation Phase: The general public or retail investors or traders catches on, driving prices further in the direction of the trend.

- Distribution Phase: Smart money (Informed or institutional investors) exits the market, and the trend begins to reverse.

Indices Must Confirm Each Other : For a trend to be considered valid, movements in related market indices must confirm one another. For example, if Index X and Index Y both are related indices, then if Index X is in an uptrend but the Index Y is in a downtrend, the trend may not be sustainable. Another example is if the DJIA (Dow Jones Industrial Average) is in an uptrend, but the DJTA (Dow Jones Transportation Average) is in a downtrend, the trend may not be sustainable.

Volume Confirms the Trend :Trading volume should increase in the direction of the primary trend. For example, if a financial instrument is in a bull market, volume should rise during upward price movements and decrease during corrections. If it is not happening, then the price or trend may not be sustainable.

Trends Persist Until Clear Reversal Signals Appear : A trend remains in effect until evidence proves it has reversed. This principle emphasizes that predicting trend reversals prematurely can be risky.

How to Apply Dow Theory in Modern Trading

While Dow Theory was developed over a century ago, its principles remain relevant in today’s market. Here’s how you can apply Dow Theory to your trading strategy:

Identify the Primary Trend : Use long-term charts (weekly or monthly) to determine the primary trend. Look for higher highs and higher lows in an uptrend or lower highs and lower lows in a downtrend.

Analyze Volume : Pay attention to trading volume to validate the trend. Increasing volume during an uptrend or downtrend suggests strong participation, while declining volume may indicate a weakening trend.

Watch for Trend Reversals : Use technical indicators, such as moving averages or trendlines, to identify potential trend reversals. A break below a key support level in an uptrend, for example, could signal a reversal.

Combine with Other Tools : While Dow Theory provides a solid foundation, it’s often used in conjunction with other technical analysis tools, such as candlestick patterns, Fibonacci retracements, and momentum indicators.

Risk Management : Reduces the likelihood of acting against the prevailing market direction.

Limitations of Dow Theory

While Dow Theory is a powerful tool, it’s not without its limitations:

Lagging Nature: Dow Theory relies on historical price data, which means it may not always predict future movements accurately.

Subjectivity: Identifying trends and reversals can be subjective, leading to different interpretations among traders.

Focus on Long-Term Trends: This may not be suitable for short-term traders or day traders.

Market Evolution: The modern market is more complex than in Dow’s time, with factors like algorithmic trading and global events influencing prices.

Also Watch: The Ultimate Guide to Trading Charts

Must Watch: Why Most Retail Traders Struggle to Short Stocks or Cut Their Losses

Conclusion

Understanding Dow Theory: Dow Theory remains a timeless and invaluable tool for understanding market trends and making informed trading decisions. By focusing on the principles of trend identification, confirmation, and volume analysis, traders can gain a deeper understanding of market behavior and improve their chances of success.

Pingback: Why Do Most People Choose Trading as a Career and Fail?

Pingback: Price Movements in The Stock Market: Uptrend, Downtrend